Wyoming LLC – Should You Form an LLC in WYOMING?

An LLC protects you, or I should say your business assets, from your personal liability and damages.

That said, you should form an LLC in the state you’re doing business in.

However, many people choose to form an LLC in Wyoming for obvious reasons.

In this article I explain these reasons, how the Wyoming LLC works, why you might need it, and whether or not you should form an LLC in WYOMING.

But first, what is an LLC?

[toc]

What is an LLC?

The abbreviation, “LLC” stands for “Limited Liability Company.”

Limited Liability Company (LLC) a sort of corporate veil/shield that protects a business owner from liabilities, fatalities, damages, and business-related problems that may arise in the course of doing business.

In a limited liability company, if something goes wrong in the business, the consumer or customer may not sue the business owner or founder but rather may sue the business.

All the 50 states in the United States, including Wyoming, have legislation for LLC registration which is also known as asset protection.

So, if you’re in Wyoming you can set up an LLC in Wyoming.

You do not need to go to Wyoming to have an LLC. Rather, you should form an LLC in your state.

However, sometimes, people prefer to form LLC in Wyoming.

The question is WHY?

Before I answer that, I need to clarify and stress the fact about choosing where to form an LLC.

Where Should You Form Your LLC?

Ideally, you should form an LLC in the state you own the property, rental, real estate, or do business.

If you have a Wyoming LLC and you own a rental property in Missouri, you’ll have to register that Wyoming LLC in Missouri.

Hence, you’ll be paying double fees and taxes first to the State of Missouri and second to the State of Wyoming.

So, you’ll have duplicate paperwork, and you’ll be filing duplicate annual returns to the state to sustain your LLC.

As such, you don’t need a Wyoming LLC if you’re in another state but you can have it if you wish, especially for the benefits which I’ll discuss soon.

So, who may need a Wyoming LLC?

The Wyoming LLC is for a limited number of people who need it; it’s not for everyone.

Don't miss this; Texas LLC DIY – Easy 5-Step Forming an LLC in Texas Free EIN Included

Wyoming LLC – Should You Form an LLC in Wyoming? Why?

There are two main benefits of setting up LLC in Wyoming or having Wyoming which make is a popular option for business owners, and investors when setting up an entity.

1. Ownership Privacy Benefit

Most states would require you to register the owner or the manager of the LLC.

Now most people prefer to set up their LLCs as manager-managed. They don't want to disclose their ownership position.

They prefer to be addressed as the manager or register someone else as the manager of their business.

That gives the business owner a little anonymity and privacy.

So on the records of the state for the LLC; it doesn't say who owns the business. It just says who manages it or who the president is.

Now in Wyoming and a few other states in the USA, it is possible not to disclose the owner or the manager of a LLC.

There's ways to legally get around this even on your annual reports and while renewing your company with the state such that the owner’s name is kept off the books.

This is usually handled by lawyers.

So, establishing a LLC in Wyoming can give you privacy to own assets.

However, a Wyoming LLC may not cover for other states. For instance, if you buy a property in Arizona, you need to register that Wyoming LLC into Arizona LLC.

Arizona LLC does not conceal the ownership privacy of the business owner. In states like this, the legal system asks for and registers who owns or manages a business or property.

Registering Wyoming LLC in Arizona therefore would disclose the ownership privacy that Wyoming LLC tried to conceal.

The safe way around it is to keep the business in Wyoming and other states like Wyoming that conceal the ownership privacy of the business owner.

Wyoming LLC is most recommended for businesses that don’t wish to operate or establish in states that the ownership position of the business owner is not concealed.

Besides, it’s most recommended for businesses that wouldn’t or doesn’t require a physical location, like online businesses.

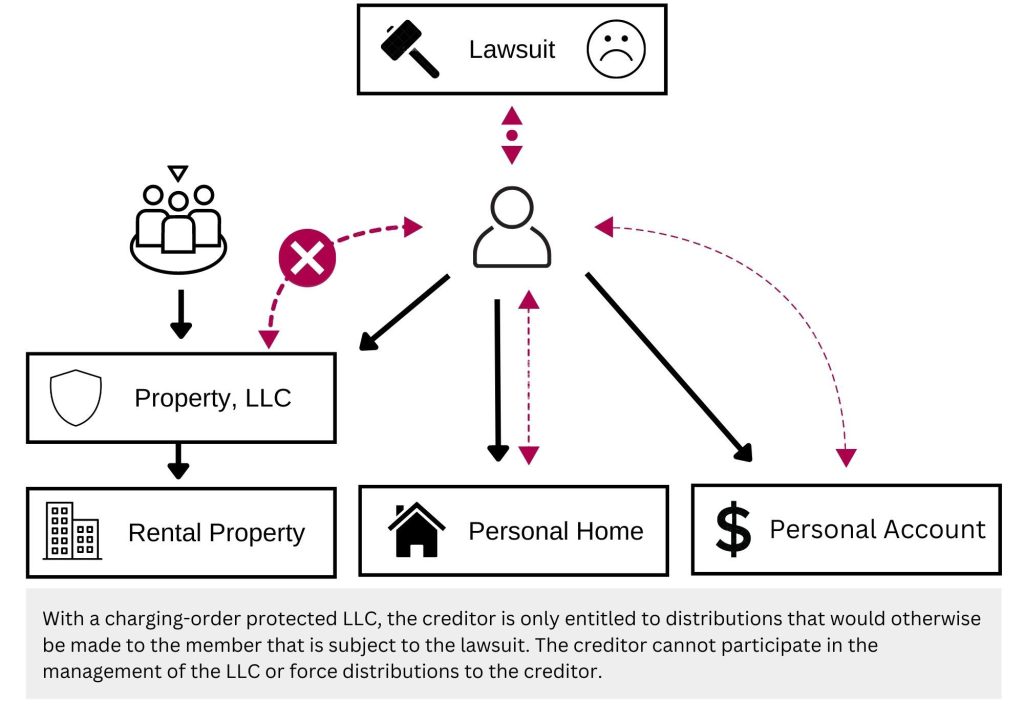

2. Charging Order Protection Entity Benefit

The second reason you may want to use a Wyoming LLC or form an LLC in Wyoming is what's called a charging order protection entity.

A charging order protection entity is essentially an entity that you or a legal firm use, primarily in Wyoming, when trying to protect the business assets, like rental property and real estate, from your personal liability.

Let’s say you’re trying to protect your rental properties from your personal liability.

Maybe you’re a doctor, a contractor, someone who gets sued in your personal name.

Well, you get a judgment against you first.

If there’s a legal case against your business and you lose the case you may forfeit everything you have in your personal name if your business isn’t registered as a LLC.

But if you own real estate or properties with a lot of equity, you can consolidate that into a property LLC and register under a Wyoming LLC.

The Wyoming LLC owns the property LLC in the state where the property is located.

So, if you’re sued, the plaintiff would have to go to the Wyoming LLC through a property LLC that owns the property.

This is called a charging order protection ID. The charging order protection entity (i.e., the property LLC) mediates or puts a boundary between you and the property holding LLC.

A Wyoming LLC prevents your properties or assets that are protected by the charging order protection from being forfeited or sold if you lose a legal case due to your business.

If a Wyoming LLC owns a Missouri LLC that owns a property in Kansas City, you won’t lose your Missouri LLC or property in Kansas City.

Without a Wyoming LLC you may also lose other properties in other states and LLCs. The charging order protection entity in Wyoming makes many people choose Wyoming as a viable place to establish a LLC.

The charging order protection entity, however, is not like a totally fail-safe tool because it's only preventing them from forcing the sale of the asset.

Conclusion

Having an LLC is a primary asset protection tool that protects you from loses or forfeiture of your assets in all states in the USA, including Wyoming.

If you have an LLC, no matter what state it's in, and there is a legal case the LLC is affected and not you, the owner. So far as the LLC owns the property and its assets of the business providing goods or services you, the owner would be exempted from damages and charges.

However, you should register, and have an LLC in the state where you own the property or conduct business. If you’re in Wyoming, you’d need a Wyoming LLC especially for its privacy benefits and charging order protection entity.

I hope this article helped you in considering Wyoming as a good place to form a LLC in the United States.